The Taskforce on Inequality-related Financial Disclosures (TIFD) Interim Secretariat hosted its Second Global Allies Meeting on Thursday, November 3, 2022. At the meeting, the Interim Secretariat provided an update on recent TIFD developments, including a summary of the small group meetings the Interim Secretariat held in September on the terms of reference of a TIFD Technical Working Group. Following the update, participants weer invited […]

Read More… from Task Force on Inequality-related Financial Disclosures (TIFD): The Second TIFD Global Meeting

The Taskforce on Inequality-related Financial Disclosures (TIFD) Interim Secretariat hosted its first Global Meeting on July 21, 2022. The July meeting took place in two parts. During the first hour, the TIFD Interim Secretariat provided an overview of TIFD – its impetus, goals, and anticipated approach and timeline – as well as information on opportunities to get […]

Read More… from Task Force on Inequality-related Financial Disclosures (TIFD): The First TIFD Global Meeting

Delilah Rothenberg spoke in a panel at the Impact Investing Adopters Forum All-Stakeholder Online Event hosted by Pensions for Purpose, which focused on ‘Disclosures: the route to environmental and social impact transparency.’ Joined by Olivia Prentice, former COO at the Impact Management Project, Ida Levine from the Impact Investing Institute, and Laure Villepelet from Tikehau […]

Read More… from Pensions for Purpose: Impact Investing Adopters Forum All-Stakeholders Online Event

PDI hosted an interactive discussion on the US SEC’s recent proposals regarding investor protections in private funds and systemic risks. As you may be aware, the SEC recently opened a comment period for proposed changes to Form PF which would require additional disclosures by private funds regarding matters that may influence systemic risks. Shortly thereafter, the SEC opened a comment period for a set of proposed disclosures and rules relating to investor protections in private funds, covering matters including fees […]

Read More… from The Predistribution Initiative: Discussion on the SEC’s Proposals Regarding Private Funds

Delilah Rothenberg spoke at the Council of Institutional Investor’s members-only webinar, “Monitoring the Cost of Private Equity.” […]

Read More… from Council of Institutional Investors (CII): 2022 Spring Conference

Delilah Rothenberg hosted the virtual launch of WBA’s Financial System Transformation Benchmark Methodology. WBA’s Financial System Benchmark will assess and rank the performance of the world’s 400 most influential financial institutions – including asset owners, asset managers, banks, and insurance companies – on their readiness to contribute to the transition towards a more inclusive and sustainable […]

Read More… from World Benchmarking Alliance (WBA): WBA Financial System Benchmark Methodology Launch

Are responsible investors unintentionally contributing to the housing crisis by competing with traditional homebuyers? Data shows that in various markets globally, record housing prices have in part been driven by investor ownership and often focused on single family homes that would otherwise be most accessible as entry-level homes for new owners. When considering the global […]

Read More… from Is there a Role for Institutional Investors in Addressing the Affordable Housing Crisis?

Critiques are growing of traditional leveraged buyout (LBO) private equity and venture capital models. Average leverage levels in typical private equity investments are at historical highs – putting companies and their stakeholders, such as workers and investors, at risk. In venture capital, the “move fast and break things” and “blitzscaling” approach often does not align […]

Read More… from Allocating Capital to New Segments of the Market with Regenerative Investment Structures

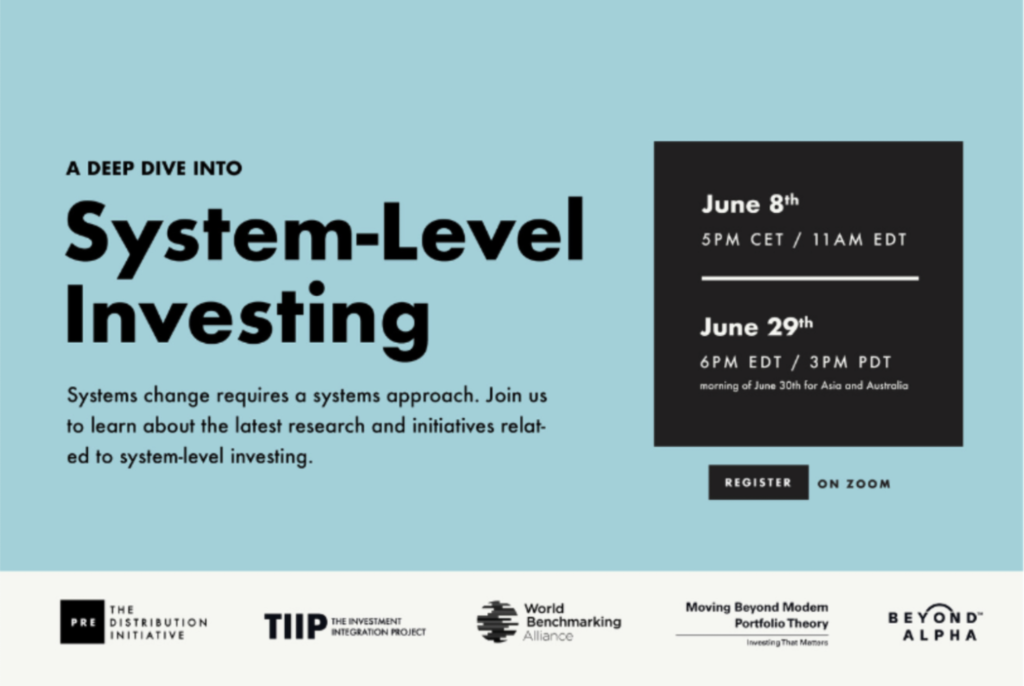

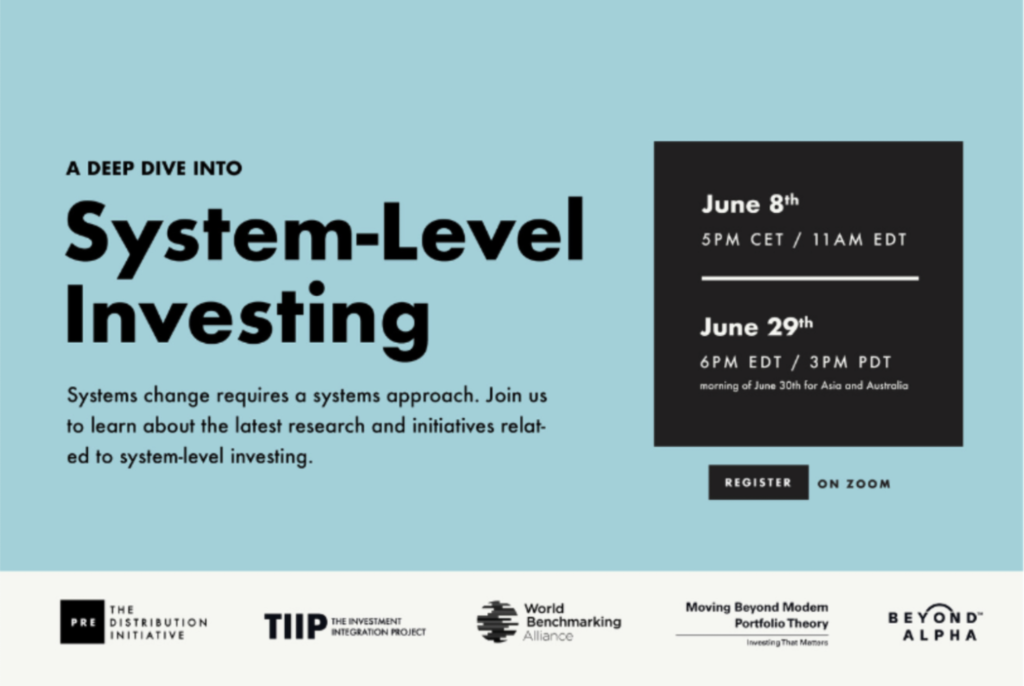

We believe systems change requires a systems approach. For investors — both asset managers and asset owners — this means taking concrete steps to rethink how investment decisions are made and how investment vehicles are structured. It also means exploring a number of key issues and questions – for instance: […]

Read More… from Deep Dive into System-Level Investing (part 2)