Forum for the Future, a non-profit that works in partnership with business, government, and civil society to accelerate the shift toward a sustainable future, published an exciting new report that builds on much of PDI’s work reimagining the way the financial system addresses systemic risks. The authors of “Finance: an agent of change?” specifically call […]

Read More… from Forum for the Future: Finance: an agent of change?

A Company’s Ability to Operate Responsibly Can be Supported or Inhibited by Capital Structures, Time Horizons, and Ticket Sizes It can be difficult for companies to have positive impacts and avoid unintended negative consequences (risks) if those companies aren’t backed by supportive investment structures. Consider WeWork and the classic venture capital (VC) model to “move […]

Read More… from PDI: Why Do We Need Regenerative Investment Structures?

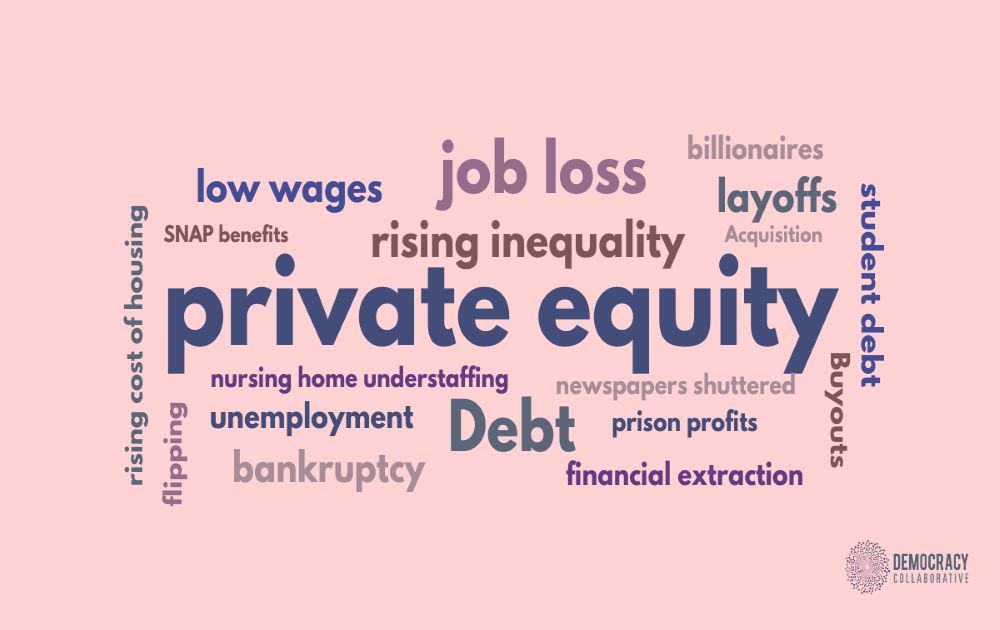

Karen Kahn and Marjorie Kelly spoke with Delilah Rothenberg, co-founder and executive director of the Predistribution Initiative, about the ways in which the private equity model drives inequality. Delilah Rothenberg has been interested in Pete Stavros’ model for sharing equity with all workers for some time. A few years ago, when she first heard about it, […]

Read More… from Fifty By Fifty: Delilah Rothenberg: A step in the right direction, but only one piece of the puzzle

As the world emerges from the pandemic with high inflation, vast inequalities, and rising oil and gas prices, it seems timely to ask how much we can expect of investors and businesses in our current system. While individual investors — people and firms — are taking on climate change and other systemic risks like inequality […]

Read More… from PDI: The Imperative to Account for Externalities: Why We Must Bridge the Gap Between Non-Financial and Financial

Much has been written about the negative consequences of public companies focused on short-term returns. Investors focused on quarterly earnings are usually blamed, along with the structure of executive compensation plans and pressure from the board of directors. The concern here is that companies are inhibiting investors’ ability to produce sustainable long-term returns.

This debate is an important one, but it is incomplete. It ignores the overall asset allocation strategies of investors across all asset classes. Investors include both asset owners and asset managers, but little can be done without substantial changes by the asset owners, who sit at the top of the “capital markets value chain.” This issue is addressed in great depth in the Working Paper “ESG 2.0: Measuring & Managing Investor Risks Beyond the Enterprise-level” by Delilah Rothenberg, Raphaele Chappe, and Amanda Feldman of The Predistribution Initiative (PDI). […]

Read More… from Asset Owners Need To Take Responsibility For System-Level Risks

A recent article by Nathaniel Bullard on Bloomberg.com noted that heady valuations and investor fear of missing out, coupled with the need to fund planetary-scale innovation has provided a tailwind for climate tech. During the first half of 2021, about $16 billion of funding was invested across carbon, consumer, energy, food and water, industrial, and mobility sectors […]

Read More… from PDI: Climate Solutions Require Supportive Investment Structures

Should we worry that non-financial corporate debt is at a historic high (both in absolute terms and relative to GDP)? Though in theory financial vulnerabilities should be of concern, there are reasons to think that alarm bells may not be ringing quite yet. In a recent opinion brief, Robert Armstrong has recently looked at this issue, and come out not “terribly […]

Read More… from PDI: A Huge Amount of Corporate Debt Might Not Be Ok for Society and Investors

All eyes have been on the U.S. Securities and Exchange Commission (SEC) following the agency’s recent invitation for public comments on how it should approach climate change and environmental, social, and governance (ESG) disclosures. Hundreds of investors, companies, sustainability advocates and civil society organizations voiced their support for the agency’s efforts to “[facilitate] the disclosure of […]

Read More… from Thomson Reuters Foundation News: Why the SEC should consider corporate and investor ESG disclosures

A new report translates the difficult questions we have on sustainability into suggested investment changes […] “Predistribution Initiative’s ESG 2.0: Measuring & Managing Investor Risks Beyond the Enterprise-level tackles these systemic issues head on, providing a detailed analysis of problematic investment trends in recent years. The paper highlights the inherent contradictions of more ‘traditional’ ESG […]

Read More… from Responsible Investor: The state of ESG 2.0: from incremental to systemic change