Are responsible investors unintentionally contributing to the housing crisis by competing with traditional homebuyers? Data shows that in various markets globally, record housing prices have in part been driven by investor ownership and often focused on single family homes that would otherwise be most accessible as entry-level homes for new owners. When considering the global […]

Read More… from Is there a Role for Institutional Investors in Addressing the Affordable Housing Crisis?

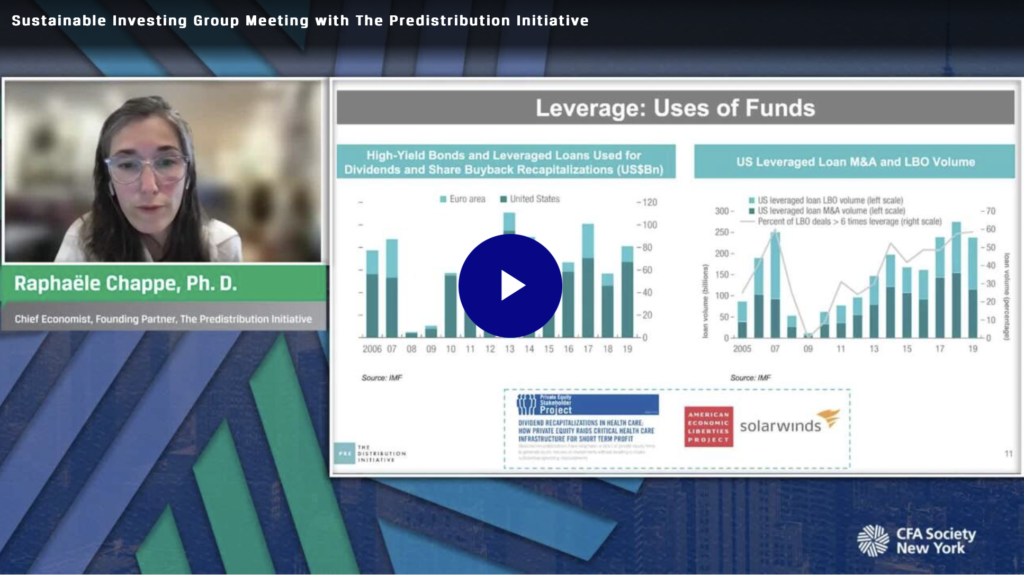

The founders of The Predistribution Initiative spoke to the members of the CFA Society of New York for a discussion of the role of institutional investors in society. The term, “pre-distribution,” was first coined by Yale political scientist, Jacob Hacker. Instead of only redistribution, which calls for addressing economic inequalities via taxes, benefits, and philanthropy after the fact, pre-distribution is the […]

Read More… from CFANY – Sustainable Investing Group Meeting with The Predistribution Initiative

Critiques are growing of traditional leveraged buyout (LBO) private equity and venture capital models. Average leverage levels in typical private equity investments are at historical highs – putting companies and their stakeholders, such as workers and investors, at risk. In venture capital, the “move fast and break things” and “blitzscaling” approach often does not align […]

Read More… from Allocating Capital to New Segments of the Market with Regenerative Investment Structures

We believe systems change requires a systems approach. For investors — both asset managers and asset owners — this means taking concrete steps to rethink how investment decisions are made and how investment vehicles are structured. It also means exploring a number of key issues and questions – for instance: […]

Read More… from Deep Dive into System-Level Investing (part 2)

Acknowledging the complexity inherent in various recommendations, this webinar is designed to offer context, tools, and approaches aimed at helping investors take difficult but important steps towards systems change. Fortunately, we have put together some of the leading thinkers on system-level investing, all in one place, all working together to explore how to refocus the […]

Read More… from Deep Dive into System-Level Investing (part 1)

In episode 92, Alex Proimos speaks with Delilah Rothenberg, co-founder and executive director of the Predistribution Initiative and Denise Hearn, co-author of The Myth of Capitalism: Monopolies and the Death of Competition and board chair of the Predistribution Initiative. The podcast is episode one in a special three-part series in association with the Predistribution Initiative […]

Read More… from The institutionalisation of capital, consolidation of flows and oligopolies in asset management | Delilah Rothenberg and Denise Hearn

In episode 95, Alex Proimos speaks with Delilah Rothenberg, co-founder and executive director of the Predistribution Initiative and Raphaële Chappe, economic advisor for The Predistribution Initiative and assistant professor of economics at Drew University. The podcast is episode two in a special three-part series in association with the Predistribution Initiative as we explore the layers […]

Read More… from The curse of financial innovation, investment structures and systemic risk | Delilah Rothenberg and Raphaële Chappe

In episode 101, Alex Proimos speaks with Delilah Rothenberg, co-founder and executive director of the Predistribution Initiative and Taylor Sekhon, director at Social Capital Partners. The podcast is episode three in a special three-part series in association with the Predistribution Initiative as we explore the layers of Influence in the capital markets value chain, incentives, […]

Read More… from Managing investor risks beyond the enterprise level, portfolio barriers and regenerative investment structures | Delilah Rothenberg and Taylor Sekhon